Sign in to the Evolve employer portal evo+

Activate your Evolve employer portal evo+ account

The Trustee of the Supertrust UK Master Trust (Supertrust) selected The Crystal Trust (Crystal) as your replacement Scheme following their decision to close Supertrust in 2020.

Crystal was established in February 2015 to enable members of other pension arrangements access to drawdown provision and to benefit from the flexibility introduced by Pensions Freedoms.

Crystal is administered by Evolve Pensions Ltd.

Crystal gained Master Trust authorisation from The Pensions Regulator in April 2019 and is an auto-enrolment scheme as defined in section 17 of the Pensions Act 2008.

Please note that Crystal is a net pay arrangement, which means that pension contributions are deducted from earnings before they are taxed. If you do not pay tax, you will not benefit from the tax relief that a tax payer would.

Investments

Crystal continues to offer you the investment options that were available in Supertrust, which offers a broad range of investment options to suit your personal circumstances and preference to investment risk.

Additionally, Crystal offers three lifestyle options depending on how you wish to receive your pension savings. There are also 14 funds that you can select, these are called self-select options. If you do not make an investment selection upon joining Crystal, you will be automatically invested in your employer’s chosen default fund.

Each strategy is monitored by the Trustee, Investment Committee and Investment Consultant, who ensure the funds are managed effectively and perform in line with the Trustees’ expectations.

If you wish to change your investment selection, please complete an Investment Option form, which can be found on evoLink. For further information, please refer to the Investment pages.

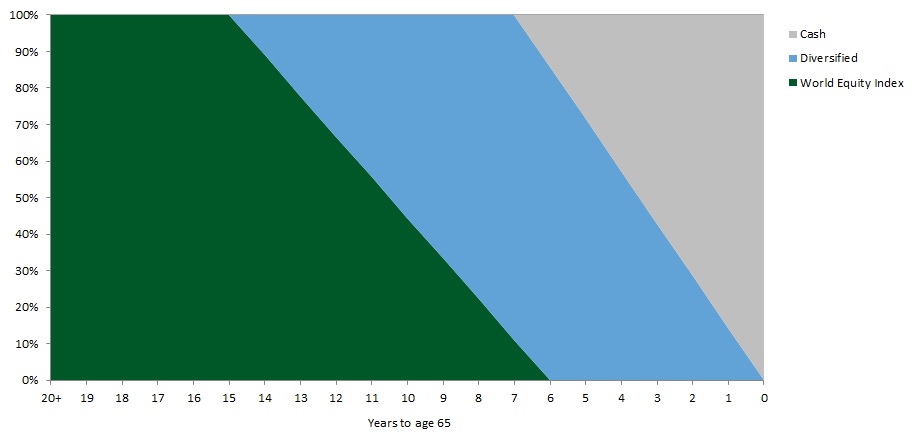

Lifestyle (Cash) Fund – Default

The Lifestyle (Cash) Fund assumes that you intend to withdraw your pension savings as a cash lump sum.

Up to 15 years before your 65th birthday your individual account is invested in company stocks and shares from around the world – to give the best chance of achieving investment growth over the long term.

During the period from 15 years up to 7 years from your 65th birthday the money in your individual account is gradually switched from company stocks and shares into the diversified multi-asset fund. This is a lower risk option that helps to protect your savings from losing value.

In the last 7 years before your 65th birthday, your money is switched from the diversified multi-asset fund into cash (the lowest risk option for short term savings) – to preserve the value of your fund for when you take your pension savings.

The chart below outlines the overall strategy, which is appropriate throughout an individual’s period of saving.

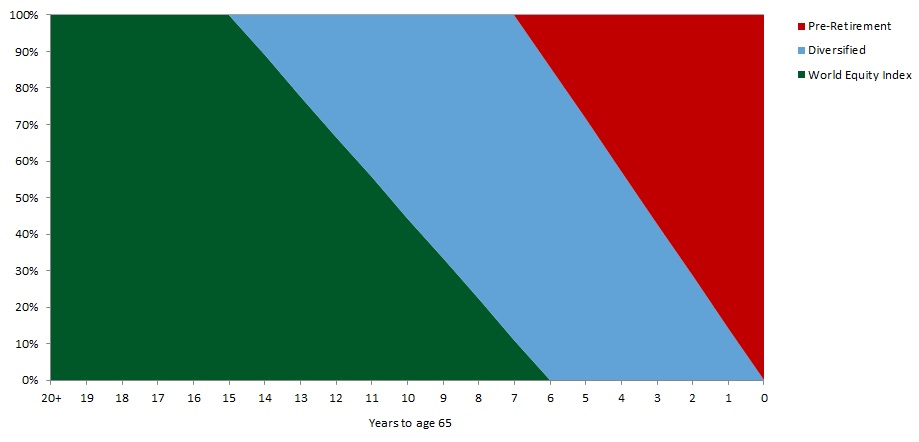

Lifestyle (Annuity) Fund

The Lifestyle (Annuity) Fund assumes that you intend to purchase an annuity (a secure income for life).

Up to 15 years before your 65th birthday your individual account is invested in company stocks and shares from around the world to give the best chance of achieving investment growth over the long term.

During the period from 15 years up to 7 years from your 65th birthday the money in your individual account is gradually switched from company stocks and shares into the diversified multi-asset fund. This is a lower risk option that helps to protect your savings from losing value.

In the last 7 years before your 65th birthday your money is switched from the diversified multi-asset fund into the pre-retirement fund to preserve the value of your fund for when you use your pension savings to purchase an annuity.

The chart below outlines the overall strategy, which is appropriate throughout an individual’s period of saving.

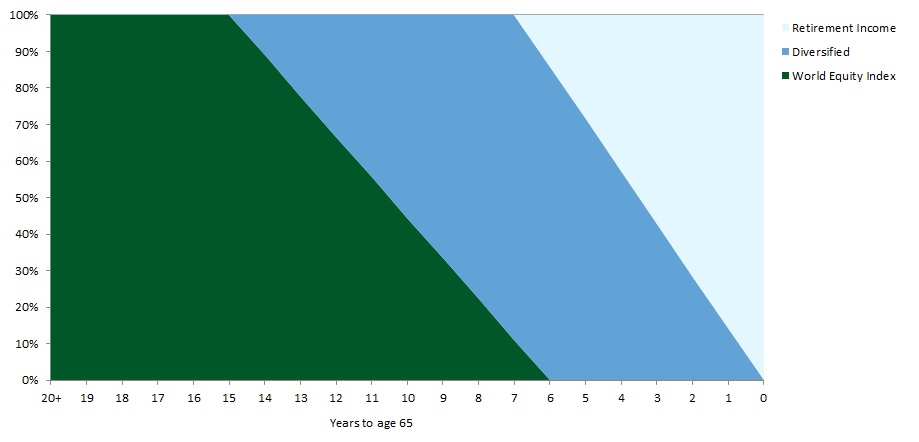

Lifestyle (Drawdown) Fund

The Lifestyle (Drawdown) Fund assumes that you intend to take an income directly from your pension savings. This is known as income drawdown.

Up to 15 years before your 65th birthday, your individual account is invested in company stocks and shares from around the world – to give the best chance of achieving investment growth over the long term.

During the period from 15 years up to 7 years from your 65th birthday, the money in your individual account is gradually switched from company stocks and shares into the diversified multi-asset fund. This is a lower risk option that helps to protect your savings from losing value.

In the last 7 years before your 65th birthday, your money is switched from the diversified multi-asset fund into the retirement income fund which aims to help preserve the value of your fund while still benefiting from long-term investment growth.

The chart below outlines the overall strategy, which is appropriate throughout an individual’s period of saving.

Self-Select

Members can choose from a range of funds provided and managed by Legal & General Investment Management Ltd.

- Global Equity Fixed Weight (50:50) GBP Currency Hedged

- UK Equity

- World Emerging Market

- World Equity Index

- World (Ex UK) Equity Index

- Crystal Shariah

- Investment Grade Corporate Bond All Stocks

- Diversified

- Dynamic Diversified

- Hybrid Property (70:30)

- Cash

- Retirement Income Multi-Asset

- Pre-Retirement

- Pre-Retirement Inflation Linked