The Trustees of the Bluesky Pension Scheme approved the transfer all of the assets to Crystal on 6th January 2020 which is now a dedicated section of Crystal.

Members of the ‘Bluesky Section of Crystal’ will benefit from the larger combined Scheme but also retain some key features:-

- The ‘Bluesky Section of Crystal’ will be managed on a ‘non-profit’ basis.

- You will see the ‘Bluesky Section of Crystal’ logo on the majority of communications.

- Existing investment options will continue to be available.

Investments

Bluesky offers first class investments allowing members the choice of a market leading default investment strategy, Target Date Funds, or a carefully selected and monitored range of self-select funds.

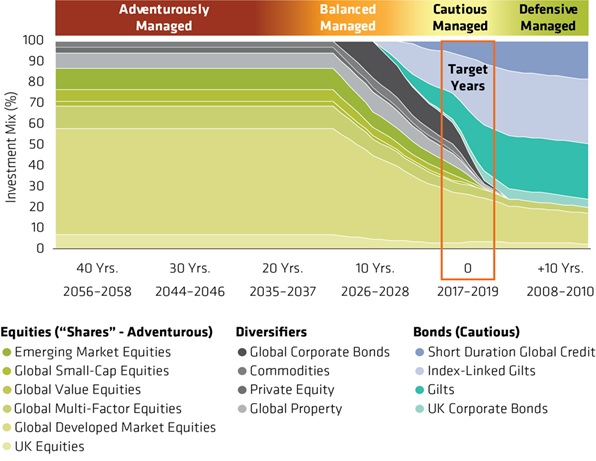

Target Date Funds

Target Date Funds are a series of funds tailored to a member’s retirement date. Each Target Date Fund is a diversified investment fund, which adjusts with age and proximity to retirement. It aims to give the highest possible pension income with a high level of risk management. Bluesky’s award winning Target Date Funds are provided by AllianceBernstein, who oversee the strategy ensuring that the mixture of assets is appropriate to the investment markets on a daily basis.

- Diversified

- Age Appropriate

- Daily Monitoring

- Risk Reducing

- Intelligent

Lifestyle

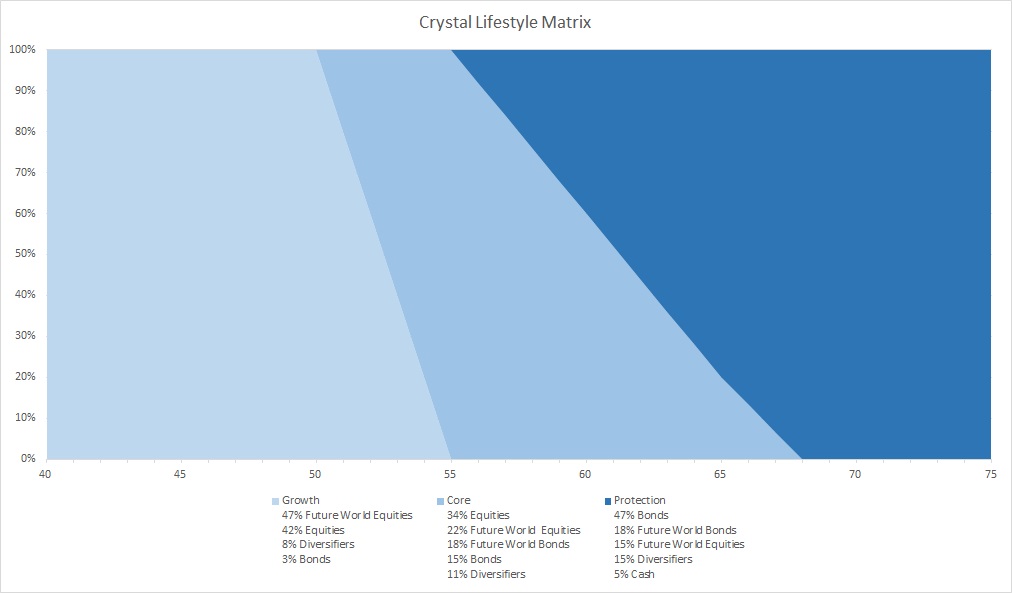

The lifestyle is designed to automatically manage members’ investments, with an aim to start reducing risk gradually from the age of 50 up to 75.

The lifestyle is designed to achieve strong investment growth in the member’s early years, then gradually switch into other asset classes to reduce exposure to the stock market as a member nears retirement age. With working patterns changing and retirement ages variable, the lifestyle strategy allows members the freedom to access their savings anytime from age 55, in the knowledge that their investments are continually monitored and adjusted, up to the age of 75.

The lifestyle strategy moves through three funds with reducing risk levels. Each fund is made up of a mix of asset classes including stocks and shares, corporate and government bonds and property. Each blend is designed by Crystal and managed by Legal and General Investment Management (LGIM). Each of these blended multi-asset funds has been given an implicit ESG (Environmental, Social & Governance score of at least 50%, this means that at least 50% of the assets in each blend either have improved ESG or are assets that cannot currently be ESG improved (such as Cash). For the ESG assets LGIM’s Future World (FW) Range is used.

The chart outlines the overall strategy, which is appropriate throughout an individual’s period of saving.

Self-Select

Members can choose from an exceptional range of funds, managed by professional investment managers and white labelled to provide additional governance:

Passive Funds

- Bluesky Global Equity Passive

- Bluesky Property

- Bluesky Cash

- Bluesky Ethical

- Bluesky Shariah

Active Funds

- BlueSky Global Equity Active

- BlueSky Bond

- BlueSky Emerging Markets

- BlueSky UK Small Cap

- BlueSky UK Equity Active

- BlueSky Responsible Investment

Latest fund factsheets

TDF

Self Select Funds

Lifestyle funds